Prices of Commodity Oils

The Author: Frank D. Gunstone, James Hutton Institute (and Mylnefield Lipid Analysis), Invergowrie, Dundee (DD2 5DA), Scotland

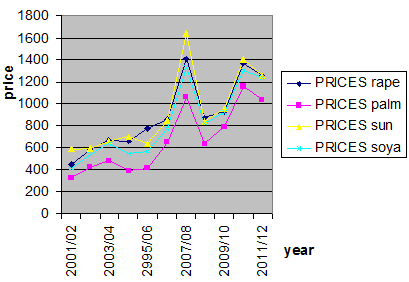

The high prices for vegetable oils attract a good deal of media attention. Figures in Table 1 and Figure 1 relate to European prices for selected oils in Rotterdam (except for the Malaysian palm oil). Prices are quoted in US$/tonne and changes in currency levels further affect the price of these commodities in countries where the local currency is not pegged to the dollar. Nor do the figures allow for the effect of inflation. From the 1950s until the 2007/08 surge in prices, the real cost of most oils and oilseeds declined by about 3% per year, corresponding to a halving of price each 20-25 years. It is apparent from Table 1 that in the recent past prices have fluctuated markedly, sometimes falling and sometimes rising quite sharply. The fall in prices during 2011/12 has continued in the early months of 2012/13.

| Table 1. Annual average vegetable oil prices (US$/tonne) between 2001/02 and 2011/12 (USDA Feb 2013) | ||||

| Rapeseed | Palm | Sunflower | Soyabean | |

|---|---|---|---|---|

| 2001/02 | 451 | 329 | 587 | 412 |

| 2002/03 | 588 | 421 | 592 | 534 |

| 2003/04 | 670 | 481 | 663 | 633 |

| 2004/05 | 660 | 392 | 703 | 545 |

| 2005/06 | 770 | 416 | 635 | 573 |

| 2006/07 | 852 | 655 | 846 | 771 |

| 2007/08 | 1410 | 1058 | 1639 | 1327 |

| 2008/09 | 868 | 633 | 837 | 826 |

| 2009/10 | 927 | 793 | 956 | 924 |

| 2010/11 | 1367 | 1154 | 1404 | 1306 |

| 2011/12 | 1258 | 1032 | 1254 | 1241 |

| Monthly figures show a larger fluctuation than annual figures, and maximum monthly prices in 2008 were palm ($1291), soybean ($1537), rapeseed ($1577), and sunflower ($2045). |

||||

Figure 1. Annual average vegetable oil prices (US$/tonne) between 2001/02 and 2011/12 (USDA Feb. 2013).

Price changes result from a mismatch of supply and demand influenced by the following factors:

- Growing demand from a rising population with increasing wealth, which is increasingly urbanised, has been estimated at 4 to 5 million tonnes extra each year. Population is expected to increase to 9-10 billion (up to 40%) before levelling out in the mid-century.

- Demand for biodiesel is also between four and five million tonnes, and while this is mainly sourced from rapeseed oil and soybean oil it is not entirely so. There are also other sources that are outside the usual listings of commodity vegetable oils such as animal fats, used frying oils, oils from new vegetable sources such as jatropha, and algal oils. There is a lot of investigation of these last two but final product is only beginning to appear in small quantities (see section on biodiesel).

- These two growing demands, each for 4-5 million tonnes (with provisos set out above), are to be compared with annual increases in production in recent years of 6-7 million tonnes. Production levels in 2011/12 are expected to be 150 million tonnes for the nine major vegetable oils and about 30 million tonnes greater when four minor vegetable oils and four animal fats are included.

- There is an increase in the cost of agricultural production and in storage and transport costs resulting from the severe rise in the price of oil.

- Oilseed yields have fallen through poor climatic conditions in many parts of the world. For example, in recent years there have been droughts in Europe, Australia, Indonesia, Ukraine, Russia, China, and South America.

- Whenever prices are changing rapidly – upwards or downwards - speculators interfere in the market and make profits for themselves.