Individual Commodity Oils and Fats

The Author: Frank D. Gunstone, James Hutton Institute (and Mylnefield Lipid Analysis), Invergowrie, Dundee (DD2 5DA), Scotland

The Four Major Vegetable Oils

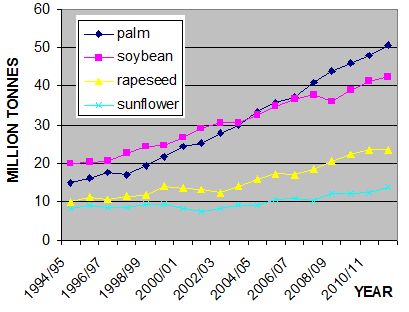

Table 1 and Figure 1 show the production levels in 1994/95 through 2011/12 for the four major vegetable oils. Over this 18-year period production of these four oils together has increased by 78.6 million tonnes. This has come from palm oil (35.8 million tonnes), soybean oil (22.5 million tonnes), rapeseed oil (13.5 million tonnes) and sunflowerseed oil (6.8 million tonnes). The graph shows clearly how production of palm oil has exceeded that of soybean oil since 2004/05 and that these two oils are increasingly dominant among the vegetable oils.

| Table 1 Production (million tonnes) for the four major vegetable oils (palm, soyabean, rapeseed, and sunflowerseed) in the 17 years between 1994/95 and 2011/12 |

|||||

| Palm | Soyabean | Rapeseed | Sunflower | Total (4) | |

|---|---|---|---|---|---|

| 1994/95 |

14.9 | 19.9 | 10.0 | 8.3 | 53.1 |

| 1995/96 | 16.2 | 20.3 | 11.1 | 9.1 | 56.7 |

| 1996/97 | 17.7 | 20.4 | 10.5 | 8.6 | 57.2 |

| 1997/98 | 16.9 | 22.4 | 11.4 | 8.5 | 59.2 |

| 1998/99 | 19.2 | 24.4 | 11.8 | 9.3 | 64.7 |

| 1999/00 | 21.8 | 24.5 | 14.0 | 9.3 | 69.6 |

| 2000/01 | 24.3 | 26.7 | 13.3 | 8.2 | 72.6 |

| 2001/02 | 25.3 | 28.9 | 13.1 | 7.4 | 74.7 |

| 2002/03 | 27.7 | 30.5 | 12.3 | 8.1 | 78.6 |

| 2003/04 | 30.0 | 30.3 | 14.1 | 9.2 | 83.6 |

| 2004/05 | 33.5 | 32.5 | 15.8 | 9.1 | 90.9 |

| 2005/06 | 35.8 | 34.8 | 17.4 | 10.6 | 98.6 |

| 2006/07 | 37.3 | 36.5 | 17.1 | 10.7 | 101.6 |

| 2007/08 | 41.1 | 37.8 | 18.4 | 10.1 | 107.4 |

| 2008/09 | 44.0 | 35.9 | 20.5 | 12.0 | 112.4 |

| 2009/10 | 45.9 | 38.9 | 22.3 | 12.1 | 119.2 |

| 2010/11 | 47.9 | 41.2 | 22.3 | 12.2 | 124.6 |

| 2011/12 | 50.7 | 42.4 | 23.5 | 15.1 | 131.7 |

Figure 1. Production (million tonnes) for the four major vegetable oils (palm, soyabean, rapeseed, and sunflowerseed) in the 17 years between 1994/95 and 2010/11.

Palm Oil

Palm oil is the vegetable oil produced in largest amount having pushed soybean oil into second place in 2004/05. Palm is generally the cheapest commodity vegetable oil and also the cheapest oil to produce and to refine. By reason of its availability and (relatively) low cost, it is an important component of the increasing intake of oils and fats in the developing world. Without the large volume of exported palm oil from Malaysia and Indonesia, there would be a major problem in meeting world demand for vegetable oil.

The oil palm originated in West Africa and was taken to Malaysia (then Malaya) by the colonial rulers in the 1870s as an ornamental. It was 1917 before the oil palm was first planted as an oil crop. The variety Tenera (a hybrid of Dura and Pisifera) is now generally cultivated. The plant is grown in a nursery for 12-18 months before it is planted in the field where it bears fruit 30 months later and has an economic life of 20-30 years. A mature tree produces 10-15 bunches a year. These are 10-20 kg in weight and have 1000-2000 fruitlets. Each 10g fruitlet has a kernel (3-8% ), which is the source of palmkernel oil. When pressed, the fruitlets give palm oil with an oil extraction rate of ~20%. A normal plantation will yield ~ 4t of palm oil/ha/year. The best plantations have yields of 7-8 tonnes/hectare and there is evidence that some are even higher. Although there are peaks and troughs, harvesting occurs all the year round producing a continuous supply of oil. The fruit bunches and fruitlets cannot be stored and extraction must be carried out as soon as possible. Many plantations have their own mill. For example, in 2005, Malaysia had 395 mills with a further 25 in the planning or construction stages.

The oil is generally refined, bleached, and deodorised (RBD oil) and much of it is fractionated to give palm olein and palm stearin thereby extending the usefulness of this oil. During refining some valuable minor products are removed though these may be trapped in a side stream for separate use. Alternative refining procedures produce a red palm oil by retaining a larger proportion of the carotenes in the crude oil. Since the carotenes are biological precursors of vitamin A, the red oil can be used to reduce blindness, particularly in children on diets otherwise deficient in carotenes.

Table 1 contains details of production, trade (exports and imports) and consumption for food and non-food purposes of palm oil in 2011/12. Total consumption is almost the same as production and imports and exports are also similar in level. Small differences in these pairs are covered by changes in stocks. So-called "ending stocks" at 6.7 million tonnes represent only 50 days supply.

| Table 1. Palm oil: production, export, import, and consumption (for food and non-food purposes) in 2011/12. All figures are million tonnes. |

|

| Production: | 50.7 (Indonesia 25.9, Malaysia 18.2, Thailand 1.5, Columbia 0.9, Nigeria 0.8, other 3.4) |

| Exports: | 39.0 (Indonesia 18.2, Malaysia 16.6, other 4.2) |

| Imports: | 38.1 (India 7.5, China 5.8, EU-27 5.2, Pakistan 2.1, Bangladesh 1.0, USA 1.0, other 15.5) |

| Consumption: | 8.9 (India 7.4, Indonesia 7.1, China 5.8, EU-27 5.1, Malaysia 3.0, Pakistan 2.1, Nigeria 1.3, Thailand 1.1, USA 1.0, Bangladesh 1.0, other 14.0) |

Production of palm oil in 2011/12 was almost 51 million tonnes coming mainly from Indonesia and Malaysia with smaller amounts from Thailand, Nigeria and Columbia and the balance from over 20 other countries. The Table contains information for the ten major consuming countries. It is clear how important imported palm oil is to the highly-populated Indian sub-continent (India, Pakistan, and Bangladesh) with a combined annual consumption of at least 10.2 million tonnes.

Production in Malaysia has been an important element in the development of that country and in the world supply of dietary oils and fats in the last 30 years. Production in Malaysia has increased from only 1.3 million tonnes in 1975, through 4.1 million tonnes in 1985 and 7.8 million tonnes in 1995 to 18.2 million tonnes. In 2011/12, Production in Indonesia rose from an even lower base to exceed Malaysian output in 2005/06. Malaysian and Indonesian experience in producing, trading, and financing palm oil is now being exported to other counties with favourable conditions for growing the oil palm.

Malaysia and Indonesia are the dominant exporters of palm oil, exporting 91 and 70%, respectively, of the palm oil they produce. The lower proportion in Indonesia is a reflection of the population in these two countries of 237 million in Indonesia and only 30 million in Malaysia. On the basis of trade in oils and fats in 2011/12, Malaysia supplied 25.8% of world exports as palm oil with Indonesia providing 25.7% as palm oil, so these two countries together supply over one half of total trade in vegetable oils. Beyond these figures there are also exports at lower levels of palmkernel oil and of coconut oil from these countries.

The major importing countries/regions are India, China and EU-27. The USA has never been a significant consumer of palm oil and in the past denigrated the oil as a “saturated tropical oil”. Consumption has risen slightly in recent years as American food manufacturers revised their recipes to lower the level of trans unsaturated acids produced through partial hydrogenation of soybean oil. The large figure for “others” in the imports and consumption columns is an indication of the very large number of countries importing and consuming palm oil.

Palm oil is widely used in the food industry with, for example, palm olein used as a frying oil and palm stearin as hardstock in the production of spreads and cooking fats. A mid-fraction also produced during fractionation is used as a cocoa butter equivalent (CBE). Palm oil is being used increasingly for non-food purposes. In 2001/02 when production was 25.3 million tonnes, 3.9 million tonnes (15%) was used for industrial purposes. Ten years later in 2011/12 those figures rose to 50.7 and 12.8 million tonnes (25%). If or when palm biodiesel becomes a widely traded commodity, the proportion used for industrial purposes will rise still further.

Palm oil is a source of valuable minor components, particularly carotenes (especially α- and β-carotene) and tocols (especially the tocotrienols).

Palmkernel oil, which is a second product from the oil palm, is discussed in the section on lauric oils.

Soybean Oil

Soybeans are grown predominantly in North and South America (Brazil and Argentina) where 35% and 46%, respectively, of the 2011/12 total supply of beans was harvested. Further details are given in Table 1 and discussed below. It is only recently (2002/03) that total production in South America has exceeded that from the United States. In 2006/07 world production of soybeans was 236 million tonnes, but the figure fell in the two following years to 212 million tonnes due to declines first in USA and then in Argentina. The products of soybean agriculture are traded as beans and also as extracted oil and meal and these must always be distinguished.

In 2011/12, 95% of total soybean production was crushed (somewhere) and 38% was exported mainly to China and EU-27. These two countries/regions import 63 and 13%, respectively, of all traded beans. Among the three large American producers the United States crushes some of its beans for oil and meal and exports some as beans. This applies also to Brazil. In contrast, Argentina crushes most of its soybeans and exports oil and meal rather than beans.

Soybean oil is second only to palm oil in level of production and is an important oil used widely, mainly but not entirely, for food purposes. It is an unsaturated oil rich in linoleic (typically 53%) and linolenic acids (typically 8%), but these two essential acids are not present in the optimum ratio which should be around 5:1. Both these polyunsaturated fatty acids have valuable nutritional properties, but linolenic acid in particular contributes to oxidative instability, so soybean oil is generally subject to light hydrogenation to halve the content of this acid thereby enhancing shelf life. Oil bred to have a lower content of linolenic acid has become popular. For use in spreads the oil has to be partially hydrogenated to raise its content of solid triacylglycerols. This leads to the formation of saturated acids and unsaturated acids with trans unsaturation. The latter are now recognised as worse than saturated acids in their cholesterol-raising activity. Alternative recipes have been devised that reduce the requirement for partially hydrogenated fat. This is a problem particularly for the USA where fat consumed as food comes almost entirely from soybean oil. Another problem with the US soybean-based diet is the high omega-6:omega-3 ratio when a much lower ratio is desirable. In particular there is need for an increased intake of long-chain polyunsaturated fatty acids from marine sources. The figures in the Tables relating to soybean oil do not recognise those variants in which the fatty acid content has been changed by genetic or conventional seed breeding procedures.

| Table 1. Soybeans: production, trade, and crushing (million tonnes) in 2011/12 | ||||

| Production | Exports | Imports | Crushing | |

|---|---|---|---|---|

| World | 238.7 | 90.4 | 93.2 | 226.8 |

| USA | 84.2 | 37.1 | 46.3 | |

| Brazil | 66.5 | 36.3 | 36.9 | |

| Argentina | 40.1 | 7.4 | 35.9 | |

| China | 14.5 | 59.2 | 61.0 | |

| India | 11.0 | 9.6 | ||

| Paraguay | 4.4 | 3.2 | 1.1 | |

| Canada | 4.3 | 2.9 | 1.4 | |

| EU-27 | 12.0 | 12.1 | ||

| Japan | 2.8 | 2.0 | ||

| Mexico | 3.4 | 3.6 | ||

| Other | 13.8 | 3.5 | 15.8 | 16.9 |

| Missing figures are not available in USDA Tables. | ||||

| Table 2. Soybean oil: production, trade, and consumption (million tonnes) in 2011/12 | ||||

| Production | Exports | Imports | Consumption | |

|---|---|---|---|---|

| World | 42.40 | 8.52 | 8.17 | 41.76 |

| USA | 8.95 | 0.66 | 8.31 | |

| China | 10.91 | 1.50 | 11.94 | |

| Argentina | 6.84 | 3.79 | 3.07 | |

| Brazil | 7.09 | 1.88 | 5.21 | |

| EU-27 | 2.22 | 0.75 | 0.38 | 1.98 |

| India | 1.71 | 1.17 | 2.75 | |

| Mexico | 0.63 | 0.80 | ||

| Morocco | 0.37 | 0.37 | ||

| Iran | 0.41 | 0.60 | ||

| Other | 4.04 | 1.44 | 4.72 | 6.73 |

| Missing figures are not available in USDA Tables. | ||||

The production (million tonnes and % of world total) of soybeans in USA, Brazil, and Argentina is given in Table 3 for the 11 years 2001/02 to 2011/12. The general increases in production levels are interrupted through marked falls in production in USA in 2007/08 and in Argentina in 2008/09. Over the 10-year period soybean production in the USA, Brazil and Argentina rose from around 150 to over 200 million tonnes. Around 80% of world production of soybeans now comes from these three countries, though the largest producer, USA, has declined in dominance while Brazil and Argentina have risen and the South American countries together have produced more soybean than the USA since 2002/03.

| Table 1. Soybeans: production, trade, and crushing (million tonnes) in 2011/12 | ||||

| Production | Exports | Imports | Crushing | |

|---|---|---|---|---|

| World | 238.7 | 90.4 | 93.2 | 226.8 |

| USA | 84.2 | 37.1 | 46.3 | |

| Brazil | 66.5 | 36.3 | 36.9 | |

| Argentina | 40.1 | 7.4 | 35.9 | |

| China | 14.5 | 59.2 | 61.0 | |

| India | 11.0 | 9.6 | ||

| Paraguay | 4.4 | 3.2 | 1.1 | |

| Canada | 4.3 | 2.9 | 1.4 | |

| EU-27 | 12.0 | 12.1 | ||

| Japan | 2.8 | 2.0 | ||

| Mexico | 3.4 | 3.6 | ||

| Other | 13.8 | 3.5 | 15.8 | 16.9 |

| Missing figures are not available in USDA Tables. | ||||

| Table 2. Soybean oil: production, trade, and consumption (million tonnes) in 2011/12 | ||||

| Production | Exports | Imports | Consumption | |

|---|---|---|---|---|

| World | 42.40 | 8.52 | 8.17 | 41.76 |

| USA | 8.95 | 0.66 | 8.31 | |

| China | 10.91 | 1.50 | 11.94 | |

| Argentina | 6.84 | 3.79 | 3.07 | |

| Brazil | 7.09 | 1.88 | 5.21 | |

| EU-27 | 2.22 | 0.75 | 0.38 | 1.98 |

| India | 1.71 | 1.17 | 2.75 | |

| Mexico | 0.63 | 0.80 | ||

| Morocco | 0.37 | 0.37 | ||

| Iran | 0.41 | 0.60 | ||

| Other | 4.04 | 1.44 | 4.72 | 6.73 |

| Missing figures are not available in USDA Tables. | ||||

The figures for 2008/09 differ from the trend with very low production in Argentina because of severe drought conditions. Production returned to trend in 2009/10.

Rapeseed (Canola) Oil

The seed oil of Brassica napus or B. campestris (previously described as colza oil) was typically rich in erucic acid (22:1), and the seed meal had an undesirably high level of glucosinolates. These components reduced the value of both the oil and the protein meal but both have been bred out of modern rapeseed, which is now known as canola, double zero rapeseed oil, or low-erucic rapeseed oil. There is still a limited demand for high-erucic rapeseed oil, generally grown under contract as an identity-preserved crop, and used for production of erucamide, which is an essential component of polythene wrapping film. Rapeseed (of all kinds) is now the third largest source of oil, at ~24 million tonnes a year, after soybean oil and palm oil. It is grown mainly in Western Europe, China, Canada (where the canola varieties were developed), and India. Typically it contains palmitic (4%), stearic (2%), oleic (62%), linoleic (22%), and linolenic (10%) acids and has less total saturated acid than any other commodity oil. In one example its major triacylglycerols were: OOO (22%), LOO (22%), LnOO (10%), LLO (9%), and LnLO (8%).

Rapeseed oil lends itself to genetic modification and several rapeseed varieties having oils with modified fatty acid composition have been developed though it is still not clear how many of these will be economically viable. Rapeseed oils with less linolenic acid, with enhanced levels of lauric acid, stearic acid, oleic acid, or with unusual acids such as γ-linolenic acid, ricinoleic acid, or vernolic acid have all been developed for commercial exploitation. An oleic-rich variety developed in Australia, called Monola, contains about 78% oleic acid.

| Table 1. Production and trade of rapeseed and rapeseed oil (taken from previous Lipid Library report and USDA 2013 for 2010/11 and 2011/12 figures). |

||||||

| 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | |

|---|---|---|---|---|---|---|

| Rapeseed | ||||||

| Production | 46.80 | 48.52 | 58.21 | 60.96 | 60.55 | 61.56 |

| China | 12.65 | 10.57 | 12.10 | 13.66 | 13.10 | 13.43 |

| India | 5.80 | 5.45 | 7.00 | 6.40 | 7.10 | 6.50 |

| Canada | 9.00 | 9.60 | 12.64 | 12.89 | 12.79 | 14.61 |

| EU-27 | 16.01 | 18.36 | 19.01 | 21.55 | 20.75 | 19.08 |

| Other | 3.34 | 4.54 | 7.46 | 6.46 | 6.80 | 7.95 |

| Export | 6.73 | 8.12 | 12.06 | 10.79 | 10.85 | 12.96 |

| Crush | 45.03 | 46.65 | 52.00 | 56.55 | 59.47 | 60.83 |

| Rapeseed oil | ||||||

| Production | 17.60 | 18.33 | 20.37 | 22.32 | 23.68 | 24.29 |

| China | 4.61 | 3.87 | 4.70 | 5.17 | 5.06 | 5.72 |

| India | 2.13 | 1.97 | 2.06 | 2.08 | 2.57 | 2.31 |

| Canada | 1.43 | 1.67 | 1.74 | 2.01 | 2.77 | 3.13 |

| Japan | 0.89 | 0.90 | 0.88 | 0.90 | 1.00 | 1.05 |

| EU-27 | 6.46 | 7.57 | 8.43 | 9.37 | 9.26 | 8.98 |

| Other | 2.08 | 2.35 | 2.56 | 2.79 | 3.03 | 3.10 |

| Export | 1.95 | 1.93 | 2.38 | 2.74 | 3.45 | 3.97 |

| Consumption | 17.99 | 18.41 | 19.92 | 22.42 | 23.54 | 23.75 |

| Blank cells relate to figures that are not available | ||||||

Sunflower Seed

Sunflower seed oil is obtained from Helianthus annuus and is grown mainly in Russia, Ukraine, Argentina, some EU-27 countries, China, and USA. The oil normally contains 60-75% of linoleic acid with >90% of oleic and linoleic acids combined and virtually no linolenic acid. Its major triacylglycerols are typically LLL (14%), LLO (39%), LLS (14%), LOO (19%), LOS (11%), and other (3%). It is widely used as a cooking oil and is valued as an important component of soft spreads especially in Western Europe. High-oleic varieties have been developed. Sunola (Highsun) comes from a high-oleic variety and has about 85% oleic acid (some samples reach 90%) and is used to meet the growing demand for high-oleic oils. NuSun with ~ 60% oleic acid has been developed in the USA and it is hoped that it will replace regular sunflower oil in that country. In the ten years between 2001/02 and 2011/12, sunflowers have been cultivated on 19-26 million hectares producing 21-40 million tonnes of seed and 7.4-15.1 million tonnes of oil therefrom.

| Table 1. Production and trade (million tonnes) of sunflower seeds and sunflower seed oil (taken from previous Lipid Library report and USDA 2013 for 2010/11 and 2011/12 figures) |

||||||

| 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | |

|---|---|---|---|---|---|---|

| Sunflower seed | ||||||

| Production | 30.18 | 27.02 | 33.03 | 31.62 | 33.46 | 40.30 |

| Argentina | 3.50 | 4.65 | 2.90 | 2.30 | 3.67 | 3.34 |

| Russia | 6.75 | 5.65 | 7.35 | 6.42 | 5.35 | 9.63 |

| Turkey | 0.85 | 0.70 | 0.83 | 0.80 | 1.00 | 0.92 |

| Ukraine | 5.30 | 4.20 | 7.00 | 7.60 | 8.40 | 10.50 |

| EU-27 | 6.48 | 4.80 | 6.94 | 6.91 | 6.90 | 8.29 |

| Other | 7.30 | 7.02 | 8.01 | 7.59 | 8.15 | 7.61 |

| Export | 1.80 | 1.41 | 2.20 | 1.57 | 1.79 | 2.00 |

| Crush | 26.87 | 24.11 | 28.65 | 29.19 | 29.89 | 36.71 |

| Sunflower seed oil | ||||||

| Production | 10.93 | 9.85 | 11.73 | 12.10 | 12.29 | 15.12 |

| Argentina | 1.42 | 1.75 | 1.44 | 1.15 | 1.55 | 1.43 |

| Russia | 2.45 | 2.13 | 2.56 | 2.50 | 2.08 | 3.55 |

| Turkey | 0.52 | 0.54 | 0.51 | 0.63 | 0.67 | 0.72 |

| Ukraine | 2.05 | 1.73 | 2.63 | 2.97 | 3.33 | 4.35 |

| EU-27 | 2.22 | 1.77 | 2.33 | 2.59 | 2.56 | 2.92 |

| Other | 2.26 | 1.92 | 2.25 | 2.25 | 2.09 | 2.15 |

| Export | 4.24 | 3.36 | 4.50 | 4.49 | 4.58 | 6.42 |

| Consumption | 10.29 | 8.94 | 10.75 | 11.35 | 11.55 | 12.98 |

Palmkernel and Coconut (Lauric) Oils

Most vegetable oils contain varying proportions of palmitic (16:0), oleic (18:1), and linoleic (18:2) acid as major constituent fatty acids. These are generally accompanied by low levels of stearic acid (18:0) and sometimes by linolenic acid (18:3). Less commonly, there are vegetable oils with much of these acids replaced by short- and medium-chain fatty acids (8:0 caprylic, 10:0 capric, 12:0 lauric, and 14:0 myristic acid). Lauric acid is dominant among these and oils of this type are called lauric oils. Two commodity oils fall into this category – palmkernel and coconut – and both are tropical tree products. Typical fatty acid composition is given in Table 1. Both have high levels of lauric acid but the two oils differ from one another in that the combined level of C8 and C10 acids is higher in coconut oil balanced by a lower level of oleic acid. Other oils are known with high levels of caprylic, capric, and myristic acids, but these are not readily available in the market place.

| Table 1. Fatty acid composition (wt %) of the two commodity lauric oils | ||||||||

| 8:0 | 10:0 | 12:0 | 14:0 | 16:0 | 18:0 | 18:1 | 18:2 | |

|---|---|---|---|---|---|---|---|---|

| Palmkernel | 3 | 4 | 45 | 18 | 9 | 3 | 15 | 2 |

| Coconut | 8 | 7 | 48 | 16 | 9 | 2 | 7 | 2 |

Table 2 below provides figures for production, trade, and consumption of palmkernel oil and of coconut oil for the period 2006/07 to 2011/12. Readers will be able to derive information for themselves but here are some comments.

-

The combined production of these two oils has risen from 7.7 to 9.6 million tonnes in the last six years with increase coming almost entirely from palmkernel oil, which is now the major lauric oil. This is linked to the increasing area under oil palm cultivation leading to more palm oil and more palmkernel oil.

-

For palmkernel oil, the main sources are Malaysia and Indonesia, and for coconut oil it is Philippines, Indonesia, and India. Exports of these two oils come mainly from Malaysia, Indonesia, and Philippines, and the major importers are EU-27 and USA. There is very little trade in copra and in palmkernels.

-

Over the last ten years or so there has been considerable development of the oleochemical industry in South East Asia, particularly in Malaysia, with the result that increasing quantities of the lauric oils are used in the country of origin.

The lauric oils are used extensively for both food and nonfood purposes (probably close to a 1:1 ratio) and the range of uses is extended by hydrogenation, fractionation and by interesterification. The last is often carried out with a blend of lauric and nonlauric oils, and is catalysed by chemical reagents or by appropriate lipases. Nonfood uses are mainly linked with the useful surfactant properties of C12 and C14 chains. Major food uses include spreads, (shallow) frying oils, filling creams for biscuits and cakes, ice cream, nondairy whipping creams, coffee whiteners, and medium-chain triglycerides (MCT).

| Table 2. Production, trade, and consumption (food and nonfood) of coconut and palmkernel oils (million tonnes, taken from previous Lipid Library report and USDA 2013 for 2010/11 and 2011/12 figures) |

||||||

| 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | |

|---|---|---|---|---|---|---|

| Copra* | ||||||

| Production | 5.37 | 5.72 | 5.88 | 5.88 | 6.02 | 5.54 |

| Exports | 0.13 | 0.13 | 0.11 | 0.12 | 0.12 | 0.11 |

| Crush | 5.16 | 5.66 | 5.81 | 5.81 | 6.09 | 5.51 |

| Coconut oil | ||||||

| Production | 3.22 | 3.53 | 3.63 | 3.62 | 3.83 | 3.56 |

| Exports | 1.74 | 1.93 | 1.52 | 2.91 | 1.71 | 1.85 |

| Consumption | 3.28 | 3.46 | 3.46 | 3.88 | 3.81 | 3.73 |

| Palmkernels | ||||||

| Production | 10.18 | 11.10 | 11.74 | 12.22 | 12.55 | 13.31 |

| Exports | 0.15 | 0.10 | 0.15 | 0.02 | 0.02 | 0.02 |

| Crush | 10.04 | 11.01 | 11.57 | 12.29 | 12.42 | 13.23 |

| Palmkernel oil | ||||||

| Production | 4.48 | 4.90 | 5.14 | 5.50 | 5.55 | 5.91 |

| Exports | 2.12 | 2.49 | 2.58 | 2.91 | 2.81 | 2.53 |

| Consumption | 4.54 | 4.49 | 4.83 | 4.92 | 5.25 | 5.68 |

| *Copra is dried coconut flesh and is extracted to give coconut oil. | ||||||

Olive Oil

Olive oil (Olea europaea) is a major vegetable oil obtained from the mesocarp of the fruits of the olive tree. The oil has a long history with many biblical references. Olive trees bear fruit for over 100 years.

Annual production is around three million tonnes with commercial cultivation of the tree confined almost entirely to the Mediterranean countries of Spain, Italy, Greece, Tunisia, Morocco, Syria, and Turkey. Olive oil is an important part of the Mediterranean diet associated with low incidence of coronary heart disease. Its oxidative stability and unique flavour are linked to the fatty acid composition of the oil, particularly its high level of oleic acid, and to its many minor components still present in virgin (i.e. unrefined) oil. However new sources of olive oil are being developed in Australia and in California.

Virgin olive oil is produced from the first pressing of olives, and other grades of lower quality are produced subsequently. The oil is recovered without use of solvent and the highest quality oil is used without further refining. The quality and processing of several grades of olive are defined by Codex Alimentarius and by EU Commission Regulations (European Communities Commission 1991, 1998, and 2001). The regulations provide defined value ranges for physical and chemical properties and for composition of minor fatty acids and sterols.

Olive oil is characterised by a high level of oleic acid with Codex ranges of 8-20% for palmitic acid, 55-83% for oleic acid, and 4-21% for linoleic acid. Other acids present in trace amounts include myristic, palmitoleic, heptadecanoic, heptadecenoic, linolenic, and C20, C22, and C24 saturated acids. A mean fatty acid composition of 78 Greek olive oils indicates the presence of palmitic (10.5%), stearic (2.6%), oleic (76.9%), and linoleic acids (7.5%) in addition to nine other acids each present at a level of less than 1.0%.

Olive oil is characterised by a range of unsaponifiable constituents (total 0.5-1.5%), some of which confer high oxidative stability. They include tocopherols (usually 100-300 mg/kg and almost entirely α-tocopherol) and squalene, which may be 40-50% of total unsaponifiable material. This acyclic C30 hydrocarbon is the biological precursor of the sterols and is present at a higher level (700-12000 mg/kg of oil) in olive oil than in other vegetable oils (usually only 50-500 mg/kg). It can be recovered from olive oil deodorizer distillate. Other minor components include carotenoids, chlorophylls responsible for the greenish colour of virgin olive oil, sterols (desmethylsterols, 4α-methylsterols, 4,4-dimethylsterols or triterpene alcohols, triterpene dialcohols, and hydroxyterpenic acids), fatty alcohols and waxes, polyphenols, and volatile and aroma compounds. Several of these show antioxidant properties and add to the nutritional value of this oil.

| Table 1. World production, trade, and consumption (million tonnes) of olive oil taken from previous Lipid Library report and USDA 2013 for 2010/11 and 2011/12 figures) |

||||||

| 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | |

|---|---|---|---|---|---|---|

| Production | 2.91 | 2.84 | 2.97 | 3.05 | 3.25 | 3.39 |

| Exports | 0.71 | 0.65 | 0.68 | 0.70 | 0.75 | 0.84 |

| Consumption | 2.88 | 2.92 | 2.95 | 2.99 | 3.02 | 3.07 |

Animal Fats

Animal fats, comprising butter, lard, tallow, and fish oil, play a diminishing role in the supply and distribution of oils and fats but together they still provide around one-sixth of the total, and it may surprise some readers that in terms of production level tallow, lard, and butter occupy positions 5, 6, and 7 after the four leading vegetable oils of palm, soya, rape, and sunflower. Butter may be considered as a by-product of liquid milk production though it is one of the major reasons for producing milk. Lard and tallow are more truly by-products and production levels depend on the demand for meat (pork, lamb, and beef). Fish oils are by-products of the demand for fishmeal in the aquaculture industry. Small but increasing amounts of fish oil are used as a dietary supplement, usually in encapsulated form, and often after some concentration of the active components, eicosapentaenoic acid and docosahexaenoic acid.

The diminishing demand for land animal fats in general and for ruminant fats (butter and tallow) in particular is linked to the presence in these fats of high levels of saturated acids, trans acids, and cholesterol, and to low levels of polyunsaturated fatty acids. Despite this last observation animals reared on pasture rich in omega-3 acids as opposed to animals fed on omega-6-rich oil meals are for some communities the second best source of long-chain polyunsaturated fatty acids more commonly obtained by eating fish. This is important in Australia/New Zealand and in some parts of Europe. However, animal fats are not consumed by vegetarians and among meat eaters there is a growing concern for animal welfare during life and at slaughter.

Diseases in cows, particularly BSE (bovine spongiform encephalopathy) during the 1990s led to a reform of rendering procedures and a stricter classification of the resulting tallow. Only the highest quality tallow is now defined as food grade and other uses must be found for the nonfood grades. Increasing quantities are used for biodiesel production (up to 1 million tonnes).

Table 1 contains information on the production of butterfat, lard, tallow, and fish oils over a four-year period. Fish oils are fairly constant at around one million tonnes a year and are produced mainly in South America (Peru and Chile), Europe (mainly from Denmark, Norway, and Iceland), and Japan. The three land animal fats continue to increase in production, even though they are a diminishing portion of the global supplies of oils and fats. The final column in the Table shows that in relation to production levels there is a significant trade in fish oils. Trade in the land animal fats is limited and is virtually nonexistent for lard, indicating that this material is almost wholly consumed in the country of origin. There is only a modest trade in butter (except from New Zealand) and a little more trade in tallow. For butter the major producers are India, EU-27 (particularly Germany and France), USA, and Pakistan. In the Indian subcontinent, butter is consumed as ghee – a milk product with very little water (below 0.2%), which keeps better under tropical conditions. The major producers of lard are China, EU-27, USA, Brazil, and Russia. Tallow is produced mainly in the USA, EU-27, China, Brazil, and Australia.

| Table 1. Production and exports (million tonnes) of animal fats in the period 2005/06 to 2008/09. Figures are taken from Oil World Annual 2009. |

|||||

| Annual production (million tonnes) | Exports | ||||

|---|---|---|---|---|---|

| 2005/06 | 2006/07 | 2007/08 | 2008/09 | ||

| Butter | 6.73 | 6.87 | 7.04 | 7.15 | 0.65-0.75 |

| Lard | 7.65 | 7.63 | 7.73 | 7.78 | 0.11-0.14 |

| Tallow & grease | 8.46 | 8.52 | 8.58 | 8.46 | 2.21-2.35 |

| Fish oil | 1.00 | 1.04 | 1.06 | 1.02 | 0.67-0.76 |

| Total | 23.84 | 24.06 | 24.41 | 24.41 | |